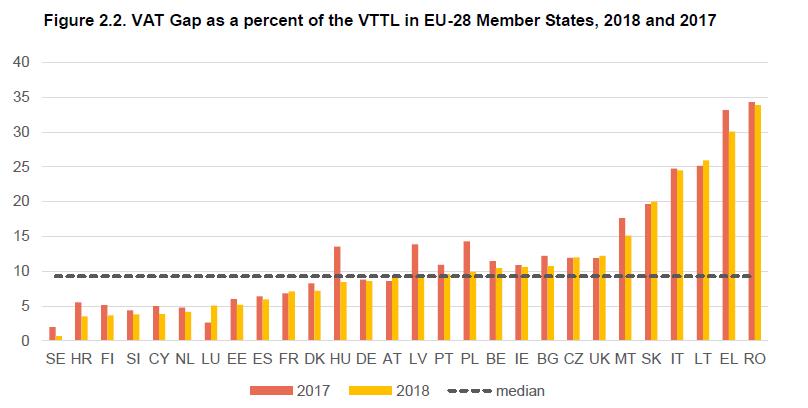

Study and Reports on the VAT Gap in the EU-28 Member States: 2018 Final Report » Ukrainian Think Tanks Liaison Office in Brussels

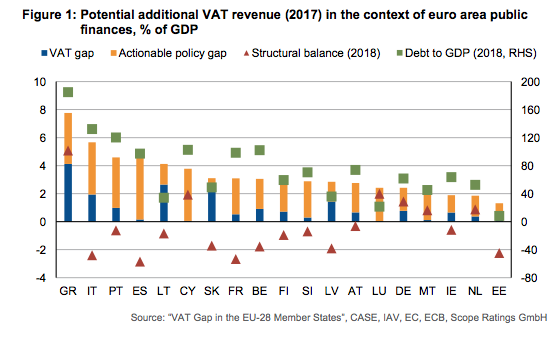

Mind the VAT gap: more effective consumption-tax collection could improve Eurozone's public finances

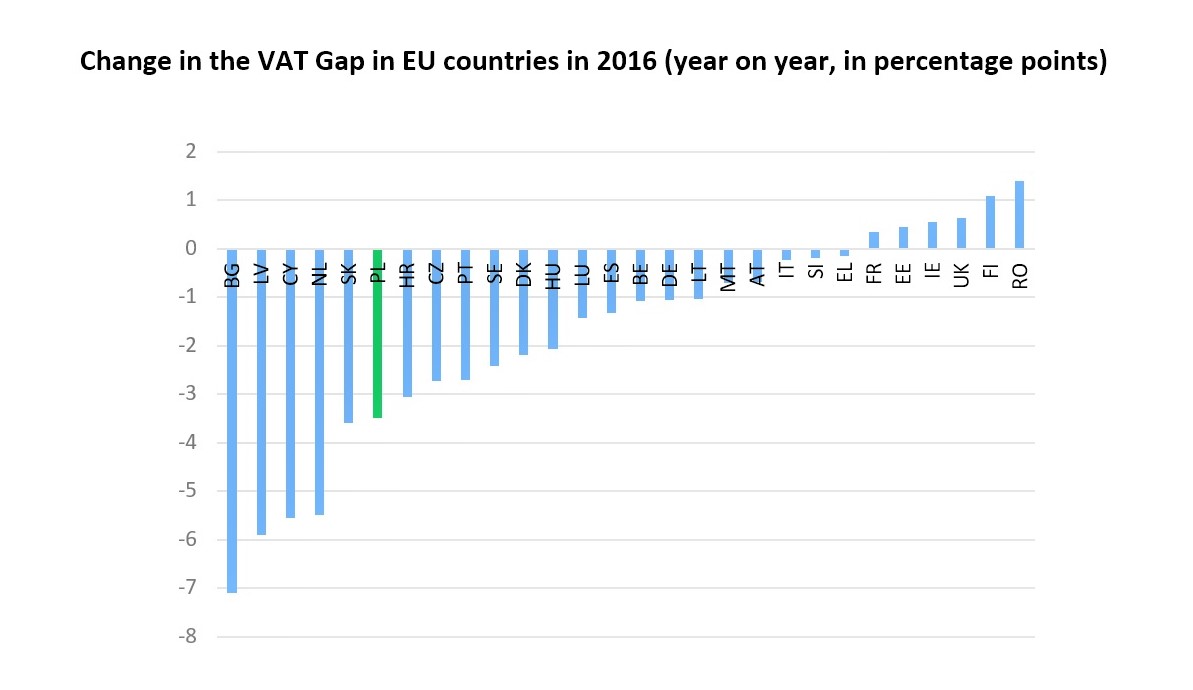

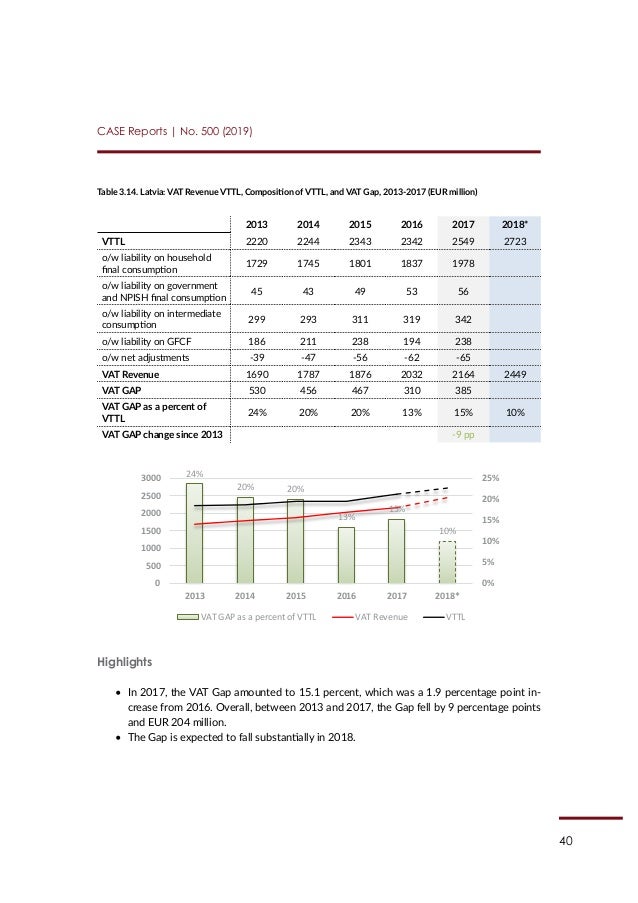

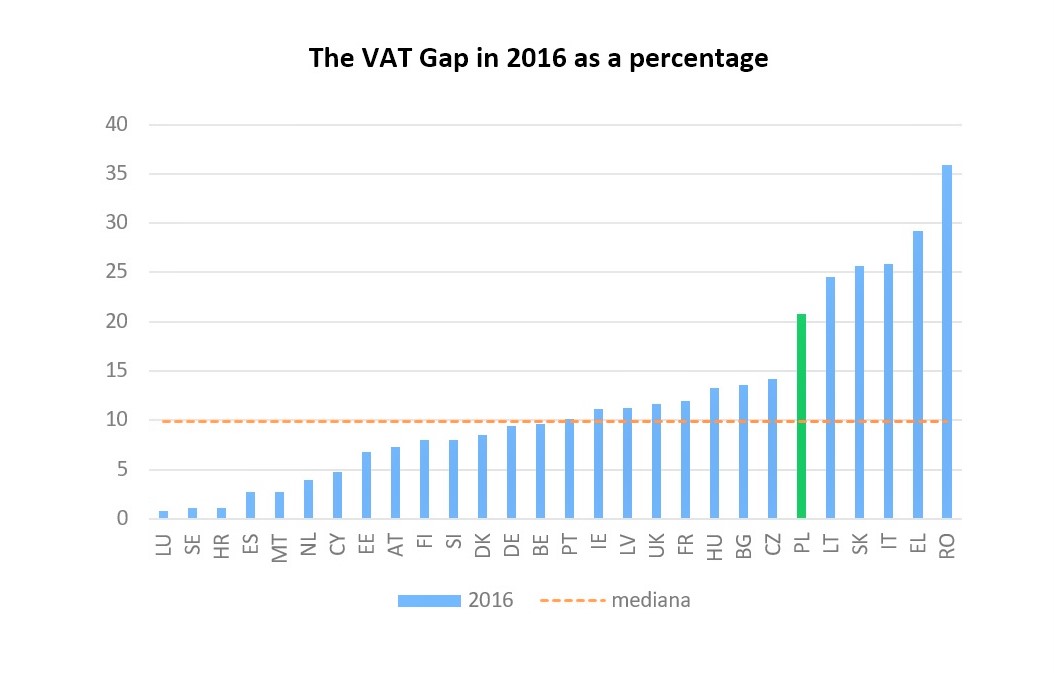

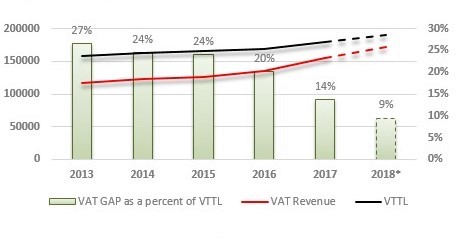

EUR 147.1 billion in VAT revenues was lost in 2016 in the EU - CASE - Center for Social and Economic Research

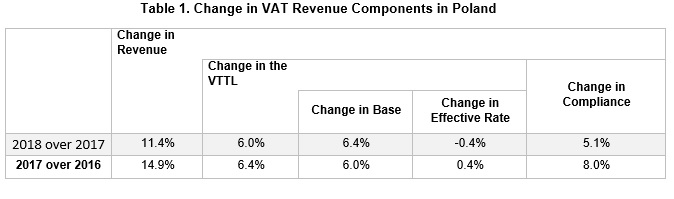

VAT Gap in Poland: policy problem and policy response The goal of proposed research project is to comprehensively examine the ev

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research